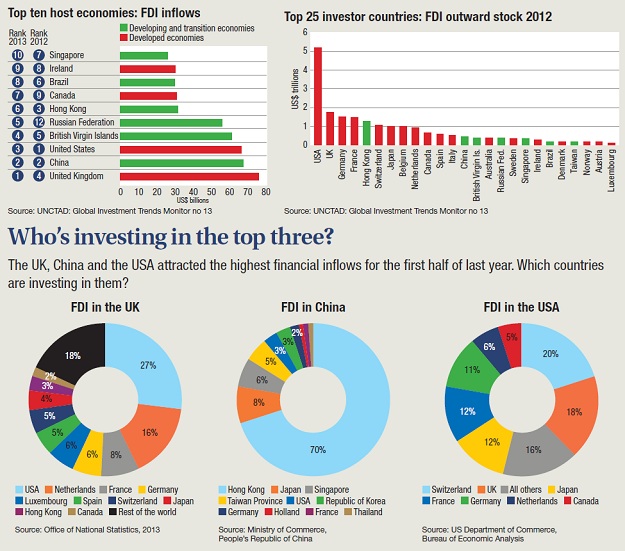

Foreign direct investment (FDI) – when companies or individuals based in one country invest in business based in another – is up by four per cent compared to this time last year. The United Nations Conference on Trade and Development estimates that FDI reached US$745 billion in the first half of 2013

Investment in developing economies, particularly Central America and the Caribbean, rose by nine per cent and accounted for 60 per cent of the global total. However, FDI in most developed economies has declined since its peak five years ago.

Bucking the trend was the UK as the leading recipient of FDI for the first half of the year. This is attributed to large deals between transnational corporations adding to already substantial investments by American and Dutch fi rms. China is the second-largest recipient of FDI, a result of increased investment in real estate and other services. And although FDI in the USA is half of its 2008 total, worldwide it is the third most popular country in which to invest.

Currently, the largest share of global investment capital resides with the USA and Europe, but this is set to change. The World Bank predicts that by 2030 developing economies will see their current share of investment stock triple – from 20 to 60 cents in every dollar invested – with countries from East Asia and Latin America being the biggest investors.